BUILDING THE FUTURE

OF QUANTAMENTAL

ANALYTICS

I am an AI developer focused on quantitative finance systems and AI agent architectures. I build end-to-end trading infrastructure, including research, backtesting, execution, and risk analytics, with experience leading AI products from concept to production and owning P&L outcomes.

Experience

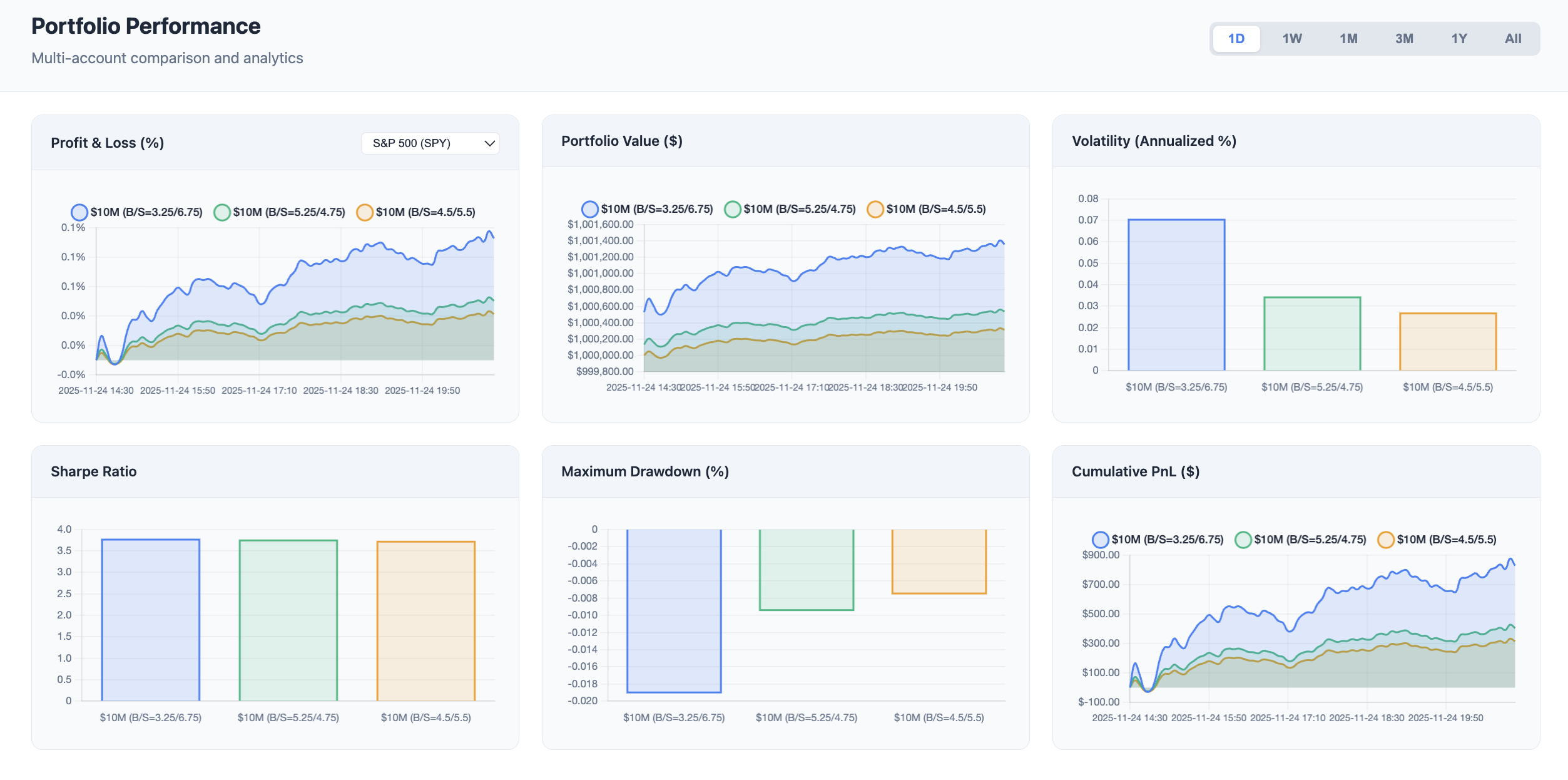

Currently building an AI-powered quantamental platform, featuring agentic rebalancing, derivative hedging, and machine learning alpha research. Focused on designing systematic analysis and research infrastructure—my thoughts live in the products I build.

Previously at FedML, Alibaba Cloud PAI (federated learning & EAS deployment), and Tencent CV Lab (defect detection engineering).

Studied at Carnegie Mellon University (MSIT) and Queen Mary University of London & BUPT (BEng & BMgt).

Interests & Activities

Multimodality Application: Building holodeck A real-time voice-to-video pipeline that turns spoken stories into cinematic sequences: streaming ASR → LLM scene planning → Flux keyframes → Mochi motion, with post-processing to deliver 4K60 output.

Private Market Research: Integrated pre-IPO and private market tracking into my official project—wish someone could sponsor me a Crunchbase API!

Recent Thoughts

It’s hard to evaluate financial analysis from multiple perspectives, so I’m diving deep into the CFA exams right now.

📍 Based in Bay Area, California • Authorized to work in the United States (no H-1B sponsorship required)